China’s devastating earthquake gave the people of Sichuan an early taste of a world that is running out of fuel.

Thousands of families slept in their cars outside petrol stations because the province’s oil infrastructure had been disrupted and its remaining fuel supplies diverted to the rescue effort. Truck drivers loitered patiently for local officials to raise their diesel rations beyond a paltry 100 yuan ($14), while taxi drivers refused to take reporters from Mianyang city to the earthquake disaster zone because they could not get enough petrol for the ride.

Kevin Tu, an energy consultant in Canada, says the earthquake and Chinese Government efforts to build huge strategic reserves in time for the Olympic Games in August will have a “huge impact” on the international market.

And yet oil demand in China and other developing countries is growing so fast, and the international market is so stretched, that international oil prices smashed through to new records this week. Sydney petrol stations were charging as much as $1.60 a litre, but there may be much worse to come. Australian petrol refineries are yet to receive oil that was bought at the new record prices.

On Thursday the world benchmark oil price hit $US135 a barrel. It has more than doubled in a year and is now higher than during the oil supply shocks of 1974 and 1980, even after adjusting for inflation.

Many politicians and the OPEC cartel of oil-exporting countries blame hedge fund speculators for pushing up the price. But the reality is probably less complicated and more serious.

“The only way to [artificially] drive prices up would be to physically hoard more oil, but stocks are at an all-time low,” says Peter Downes, a former Treasury official at the Centre for International Economics in Canberra.

The developed world is adjusting to a world of tight oil supply and high petrol prices. Australians are driving more efficient cars and drifting back to public transport. Even the United States, which consumes a quarter of the world’s oil, reduced its oil consumption in 2006.

The International Monetary Fund’s World Economic Outlook shows the rich countries that make up the OECD reduced oil consumption in each of the past two years. Japan, the world’s efficiency leader, dramatically reduced petrol consumption in the 1970s and still managed to reduce oil consumption by almost 10 per cent over the past decade. But energy efficiency improvements in the rich world are being swamped by the developing world’s rush towards rich-country living standards.

In 2003 China overtook Japan to be the world’s second largest oil consumer. China now consumes 50 per cent more oil than Japan. Chinese consumption has risen by more than 7 per cent a year since 1990.

At this growth rate, China would equal America’s current oil consumption by 2020 and double it by 2030.

About 1200 new cars are being added every day in Beijing alone. And yet only 3.3 in every 100 Chinese people own cars, compared with 77 in the United States. Chinese citizens consume one-third as much oil as Mexicans and one-twelfth as much as Americans. The country’s thirst for oil is at its early stages, and India is close behind.

The roads of Bangalore, India’s IT boom town, are perpetually gridlocked as the city’s new middle-class families rush to buy their first family cars. The number of new cars being sold in India is expected to surge from 1.3 million this year to 4 million a year over the next eight years. Last year about a dozen new car models were released in India. This year 75 new models are expected. One of them, the Tata Nano, will sell for about $2600 and open the dream of car ownership to a huge new cohort of Indian families.

India’s use of oil doubled between 1992 and 2005 and has continued to rocket.

China, India and other fast-growing developing countries have made matters worse with huge and rapidly growing fuel subsidies and price distortions, which they dare not end at a time when inflation has become a pressing political problem.

But developing world aspirations are colliding with the reality of finite oil supplies. This oil-price shock has been five years in the making but it may only just be beginning.

James Hamilton, professor of economics at the University of California, San Diego, believes the developing world will be forced to choose a different dream.

“I cannot imagine that the projected path for China will ever become a reality,” he wrote on his Econbrowser website this week. “Oil prices have to rise to whatever value it takes to prevent that from happening.”

There is simply not enough oil in the world for China, India and the developing world to emulate rich-world consumption standards.

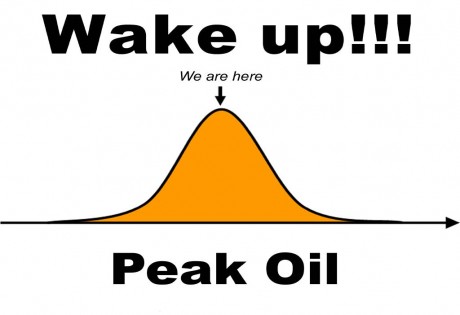

Traditionally, economists have been sceptical about the idea of “peak oil” – a point at which oil production will necessarily decline – believing that rising prices will drive oil companies to do what ever it takes to extract more oil from previously inaccessible places, such as Canadian oil sands or Brazil’s offshore discoveries, kilometres beneath the seabed.

And yet oil prices have risen seven-fold in five years and there is little in new production or discoveries. Existing oil fields, meanwhile, are running out faster than anyone predicted. The further ahead that analysts look, the worse the problem gets. Investment bank Goldman Sachs now expects oil prices to average $US141 in the second half of this year, before rising as high as $US200.

Tellingly, this week the price of oil to be delivered years into the future rose three times as fast as prices for delivery this July. On Friday it cost more than $US145 to buy oil for delivery in 2016 – up an astonishing $US19 in just one week. While OPEC oil producers are deliberately curtailing production, they, too, will face physical limits.

Downes predicts world oil production will peak between 2020 and 2030. Some outlying commentators say the moment will arrive even sooner. Germany’s Energy Research Group says the phrase “peak oil” is grammatically misleading because oil production has peaked.

For Australian motorists, the question is what international oil price will it take to force developing world consumers to choose a different path, and what will that do to the Australian economy.

It is a little known fact that only about one-third of the oil used in Australia is dispensed to consumers at the petrol pump. The rest is embedded in transport costs for other goods as well as in oil products such as plastic.

This indirect, larger oil shock impact may take nine months to flow through to consumer prices. And while Australia and the world survived oil prices rising by $US40 in four years to the middle of last year, they have now watched prices jump a further $US75 in 12 months. At the same time, prices for almost all other commodities have shot through the roof.

“You add all these together and it roughly equates to what we saw in 1980 and 1974 – major supply side shocks,” Downes says. “Financial markets have a false sense of security about what impact this will have.”

Downes estimates the recent commodity price shock will push inflation up by about 2 percentage points across the OECD, including Australia, at a time when inflation is already uncomfortably high.

Citigroup’s chief economist in Australia, Paul Brennan, yesterday said he has calculated that an average oil price of $US141 a barrel this year would push inflation up by 3.5 percentage points across the Asian region and take 1.5 percentage points off regional gross domestic product growth.

Australia remains a lucky country. It may import a lot of oil but it is a huge net exporter of energy and resource commodities. The oil price shock is part of a broader commodities boom that will continue to make Australians richer. Mortgaged home owners will pay the price, if the Reserve Bank is again compelled to raise interest rates to keep inflation under control.

Useful Websites

The Wolf at the Door – A beginners guide to Peak Oil

Related Articles:

- Iran Ends Oil Transactions In U.S. Dollars – 30 Apr.08

- Oil behind Iraq war: Nelson

- Somalia: The Hidden War for Oil

- Abid Mustafa: Bush’s Plan For Iraq and The Middle East

- New Oil Law Means Victory in Iraq for Bush

- Oil Quotes

- ‘It is the Oil, Stupid!’

- Kuwait’s biggest field starts to run out of oil

- Why Iran is next

- If hydrocarbons are renewable- then is “Peak Oil” a fraud?

- Quote of the month. Chalmers Johnson